This guide is for Shopify merchants who sell electronics, tools, or other products with built-in batteries to California customers who will be subject to the Covered Battery-Embedded (CBE) Waste Recycling Fee. Use this as a plain-language starting point before diving into the official CDTFA and CalRecycle documentation.

This guide is for general information, not legal or tax advice. If you are unsure whether a product is covered, check with the manufacturer or consult the latest CDTFA guidance.

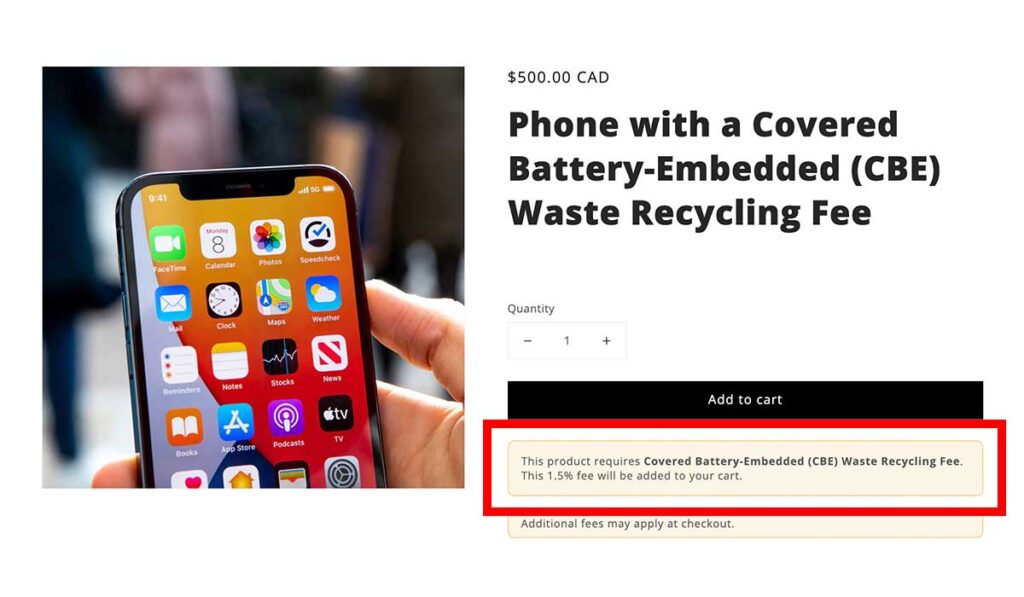

Quick Answer: What’s the Best Way to Charge CalRecycle’s 1.5% CBE Waste Recycling Fee on Shopify?

California now requires a Covered Battery-Embedded (CBE) Waste Recycling Fee of 1.5% of the retail sales price, capped at $15 per covered product, on eligible new or refurbished battery-embedded items sold for use in the state.

Shopify does not have a built-in way to do this. It cannot calculate percentage-based fees that only apply to certain products and only on California orders. The simplest approach is to use an app like Magical Product Fees to automatically add a clearly labeled “California CBE Battery Recycling Fee” at checkout on eligible orders.

Detailed Answer: How to Charge CalRecycle’s 1.5% CBE Waste Recycling Fee on Shopify With Magical Product Fees

Regulatory fees such as eco fees or bottle deposits are common around the world. Over the past four years I’ve helped many merchants set up regulatory fees on their Shopify stores through my work with Magical Apps.

Now, having received an inquiry about the California CBE Waste Recycling Fee, I decided to investigate and find out exactly what it is and what the best way is for merchants to charge it on their store.

Why California’s new battery fee matters for your Shopify store

The Covered Battery-Embedded (CBE) Waste Recycling Fee turns a pricing detail into a compliance requirement.

Starting January 1, 2026, retailers that sell covered battery-embedded products for use in California are expected to calculate 1.5% of the retail selling price, stop at a maximum of $15 per item, collect the fee at the time of sale, and show it as a separate line on the customer’s receipt.

For example, a $200 covered product would have a $3 CBE fee. A $1,200 covered product would still be capped at $15.

If you sell electronics, tools, or other products with embedded batteries into California, you either need a reliable way to charge this fee or you end up absorbing it yourself. The good news is that, for most Shopify stores, a simple fee rule using an app like Magical Product Fees is enough to handle it.

Why manual Shopify workarounds cause problems

Because Shopify product fees cannot be natively applied with fixed- or percentage-based values for specific states, merchants often reach for workarounds that seem easy but introduce friction and risk:

- Raising product prices across the board makes you look more expensive everywhere, not just in California, and does not create the separately stated fee line that regulators expect.

- Hiding the fee inside shipping or a generic handling charge muddles the breakdown for customers and your own records.

- Creating a “battery fee” product and asking customers to add it themselves leads to missed fees, manual corrections, and a checkout that feels less trustworthy.

- Manually editing orders in the admin is slow, easy to forget, and hard to keep consistent across staff and seasons.

All of these options make it harder to explain what the customer is paying for and harder to show that you handled the fee consistently.

A simple way to handle the battery fee with Magical Product Fees

Magical Product Fees gives you a cleaner way to match how the CBE fee actually works. Instead of editing prices or relying on one-off fixes, you can create a regulatory fee rules that:

- Calculate 1.5% of the price for covered battery-embedded products below $1,000

- Applies the fee at $15 per covered product for products $1,000 or more

- Only applies when the order is shipping to California

- Only runs on the SKUs or collections you mark as covered (ex. A collection for products below $1,000 or one for products above $1,000)

- Shows the charge as a separate, clearly labeled line item such as “California CBE Battery Recycling Fee” in the cart, at checkout, and on the order

Because the logic lives in the rules, you can adjust the rate or targeted products later without rewriting your catalog.

3 steps to add the 1.5% CBE fee on Shopify

1. Identify and tag covered products

Decide which products in your catalog are covered battery-embedded items and tag them in Shopify or group them into a dedicated collection. This gives you a clear target for your fee rule(s).

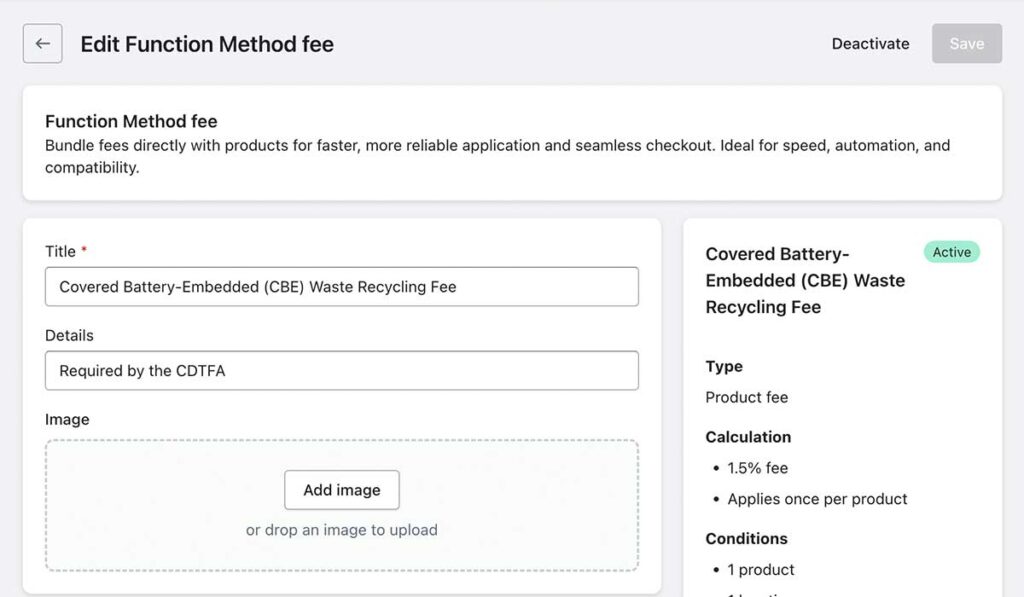

2. Create a California CBE fee rule in Magical Product Fees

In Magical Product Fees, add a new regulatory percentage-based fee such as “California CBE Battery Recycling Fee,” set it to 1.5%, and scope it so it only applies to your tagged or collected products below $1000.

If you have products above $1000, create a secondary fixed price fee of $15 which targets those products to ensure the cap is enforced.

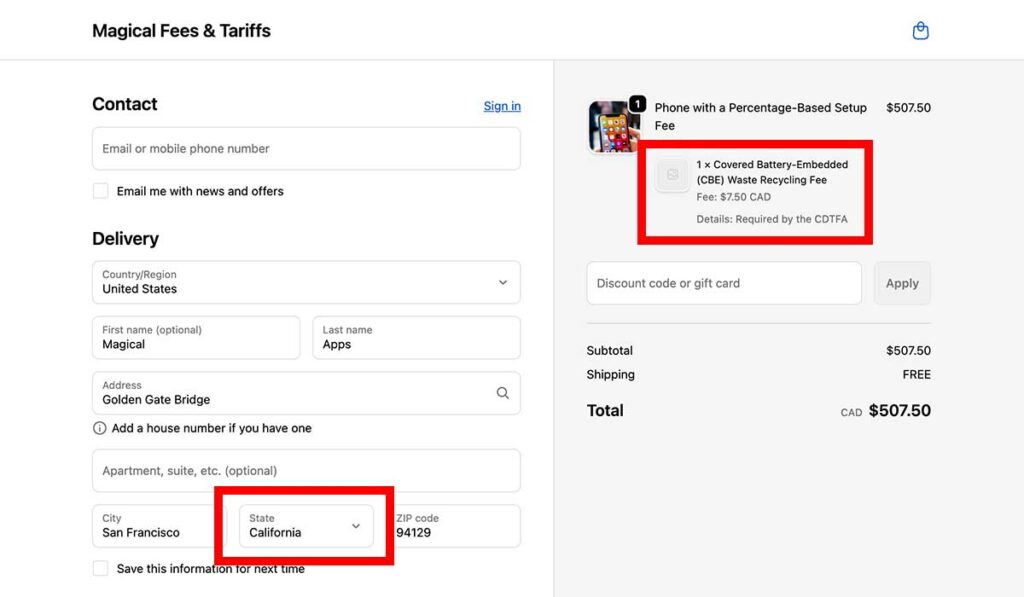

3. Limit the fee to California and test checkout

Add a location condition so the rule only triggers on orders shipping to California, then place test orders to confirm the fee appears at the correct amount and shows as a separate line on the receipt. Once it looks right, you can leave the rule active and let the app handle the fee automatically on eligible orders.

What merchants are saying about Magical Product Fees

“This app was just what we needed, a way to bulk add a percentage fee to specific collections…”

Bradford’s Rug Gallery (United States)

“Seamless solution for state regulatory compliance. Outstanding tech support with installation and customization.”

DataVision (United States)

Supporting Answers

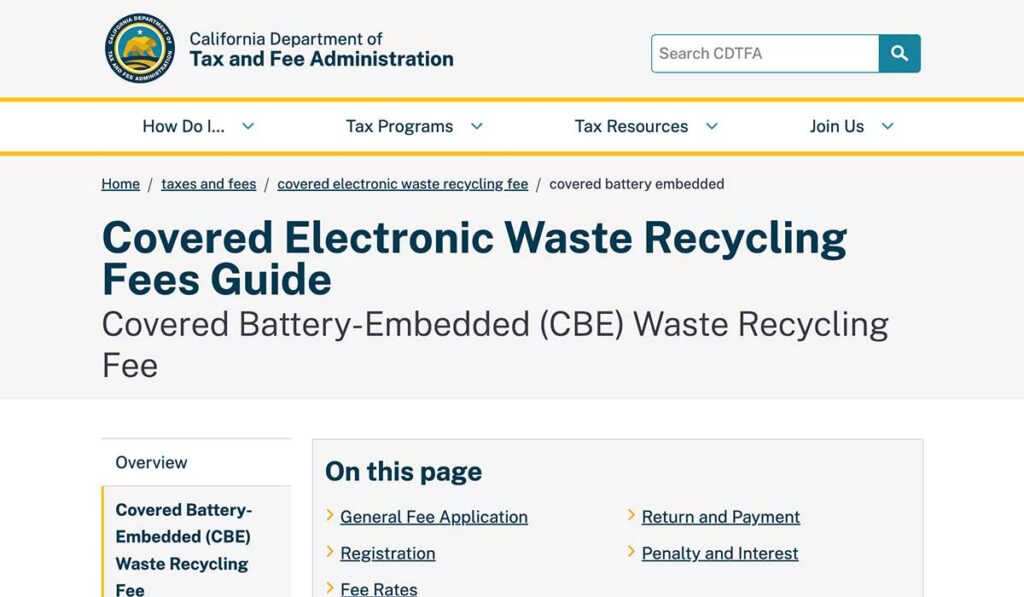

Before we dive into specific questions, it helps to know that CDTFA guidance often discusses the older Covered Electronic Waste (eWaste) fee alongside the newer Covered Battery-Embedded (CBE) waste recycling fee. This article focuses on the CBE fee, but some of the rules we cite apply to both, which is why eWaste sometimes appears in the source material.

In the supporting answers below, we cover the practical details most merchants care about once they start charging the CBE fee:

- How sales tax applies

- Whether you can absorb the fee

- Which transactions are not subject to it

- How returns work

- What out-of-state sellers need to know

- How the fee should show up on invoices and receipts

- What records you should keep for CDTFA.

Do I charge sales tax on the CBE fee?

CDTFA guidance for these fees says: do not include the CBE waste recycling fee amount in your sales or use tax calculation, and you must list it as a separate charge on the customer invoice. (Source)

Can I absorb the fee instead of charging customers?

The law allows a retailer to elect to pay the fee on the consumer’s behalf, with specific receipt statement requirements. If you absorb it, you still need a process that documents what happened on the customer’s receipt/invoice. (Source)

What transactions are not subject to the CBE fee?

CDTFA guidance lists several “not subject” situations, including (high level examples):

- Used CBE products that have not been refurbished

- Certain categories like devices already covered by the traditional eWaste fee, plus some specified medical devices and other exceptions

- Sales for resale

- Shipments delivered outside California (when the transaction is not subject to CA sales or use tax)

(Source)

What if a customer returns the product?

If you collected the fee and you provide a full refund, CDTFA guidance indicates you should also refund the applicable fee. (Source)

Do I need to register or file anything?

CDTFA’s retailer guidance indicates retailers selling or leasing covered battery-embedded products for use in California must register, and returns are filed and paid on a quarterly basis. (Source)

I sell from outside California. Do I still need to collect the CBE fee?

If you sell covered battery-embedded products to customers in California, you may still be responsible for collecting the fee even if your business is located elsewhere. CDTFA’s guidance says that if you are required to hold a California seller’s permit or a Certificate of Registration – Use Tax, you must also register for an CBE waste recycling fee account and collect the fee on sales of covered products to California customers.

If you are not required to register, you can choose to voluntarily register and collect the fee as a courtesy, but you don’t have to. In that case, the California customer is responsible for paying the fee directly to CDTFA.

For online and mail-order sales, CDTFA treats internet orders like any other sale. If you are required to collect California sales or use tax on the transaction, you are generally expected to collect the applicable CBE fee as well.

Because nexus rules and registration thresholds are nuanced, it’s worth checking with your tax advisor or CDTFA if you are unsure whether your business must register. (Sources: 1, 2)

How should I show the CBE fee on invoices and receipts?

California law requires that the CBE waste recycling fee be separately stated on the customer’s receipt. CDTFA does not prescribe a specific wording or invoice layout, but you must be able to show how much fee was collected and how it relates to the number of covered products on the order.

In practice, most merchants will either:

- List a clear line item like “California CBE Battery Recycling Fee” with the fee amount, or

- Group fees by category and type when multiple products are on the same invoice (for example, one total for CBE fees and a separate total for any traditional eWaste fees).

If you choose to absorb the fee and pay it on the customer’s behalf, CDTFA says you must note on the receipt that you paid the fee for the customer. The full fee is still due on your return, but the customer has no liability once you document that you paid it.

Apps like Magical Product Fees can help by using a consistent line-item name for the fee so your receipts, internal reports, and CDTFA returns all match.

(Source)

What records do I need to keep for the CBE fee?

In practice, this mostly means keeping clear invoices, manufacturer documentation for covered SKUs, proof of exempt sales, and copies of your filed returns.

CDTFA expects retailers to keep enough documentation to show:

- How many covered battery-embedded products were sold

- How much CBE fee was collected and reported

- Which transactions were not subject to the fee (for example, sales for resale or shipments delivered outside California)

Their guidance says records related to the CBE waste recycling fees must generally be retained for at least four years from the time the fee is due, unless CDTFA authorizes earlier destruction in writing.

For most merchants, that usually means keeping:

- Copies of invoices and receipts showing the separately stated CBE fee

- Documentation from manufacturers identifying which SKUs are covered CBE products

- Records supporting any exempt transactions (resale, out-of-state shipments, excluded product types)

- Filed CBE returns and payment confirmations

Even if you are using an app to calculate the fee, it’s worth double-checking that your Shopify orders and exports capture the line item clearly so your accountant can reconcile collections against your CDTFA filings later.

(Source)

Key Takeaway

CalRecycle’s new 1.5% CBE battery fee is a real checkout and compliance problem on Shopify because it must be calculated correctly, capped at $15, applied only to covered products and California orders, and separately stated for transparency.

The simplest path is an automated, clearly labeled regulatory fee rule using an app like Magical Product Fees rather than price hacks or manual cart workarounds.

I first started digging into the CBE fee when a merchant wrote to our support team asking how to add “a 1.5% recycling fee for batteries” only for California customers. They sold batteries both on their own and inside kits with a motor, and they needed the fee to apply only to the battery portion of the kit, not the whole bundle.

In our back-and-forth they also asked whether location-based fees required Shopify Plus and which Magical Product Fees plan they actually needed. That conversation made it clear that if one merchant was piecing this together from CDTFA bulletins, product tags, and plan details, a lot of other Shopify stores were probably in the same boat, which is what ultimately prompted me to write this guide.

If this sounds like you and you have any questions or need any help setting up a Covered Battery-Embedded Waste Recycling Fee on your Shopify store, please feel free to reach out to us and we would be happy to see if we can get the Magical Product Fees app working on your store.

Further Reading

- CalRecycle bulletin establishing the 1.5% fee and $15 cap (and the $1,000 cap example).

- CDTFA overview of the Covered Battery-Embedded (CBE) Waste Recycling Fee.

- CDTFA “Industry Topics” guidance, including sales tax treatment, invoicing, and returns/refunds.

- Public Resources Code Section 42464 (separately stating the fee, retailer collection rules).

- CDTFA L-1000 guidance for registration and quarterly filing basics.

Magical Fees

The Magical Fees app is a fast and easy way to build, customize, and attach fees to products or entire orders.